Reduction in GST slabs under Next Generation GST reforms 2.0

Government Order No. 1297-JK(GAD) of 2025 Dated:03.10.2025

Sanction is hereby accorded to the adoption of SoPs and nomination of officers for implementation of Next Generation GST

reforms 2.0 in respect of following Line Departments:

I. DEPARTMENT OF STATE TAXES

Objective :

The GST reforms that have come into force from 22nd September, 2025 has resulted in the rate reduction of numerous daily use and common man commodities ranging from daily food staples, stationery, health and life Insurance to life saving medicines etc. In order to ensure implementation of the reforms and the transfer of benefits to the consumers, the Department has laid down the following SOPs:

Sensitizing Departmental Field functionaries/ Enforcement Wings : In order to ensure the smooth, accurate and compliant

implementation of GST reform and transfer of the benefit of the reform to the consumers, the Department of State Taxes shall

sensitize its field machinery comprising of Enforcement Wings and Circle Officers in all the districts to keep a constant vigil on the

market.

Circulation of notifications : All the necessary notifications issued in this context for smooth implementation of GST reforms

shall be circulated among the stakeholders through various business/industrial associations.

Awareness Drive : Department shall conduct awareness drives through print and electronic media by issuance of advertisements

and programmes on TV and radio. The objective is to ensure wider publicity of the revised GST rates and ensure that the consumers

are sensitized on the issue.

HSN/SAC Mapping : In order to strengthen inspection on field the department shall ensure that the taxpayer shall remap HSN Codes according to the new schedules and ensure proper invoicing, billing and return filings reflecting revised GST rates and

exemptions starting from 22nd September, 2025.

Market study : The department shall compile HSN-wise list of major/common use commodities where GST rates have been

lowered. It shall also prepare a list of top market leaders in these sectors and share both the compiled lists with the Department of

Food, Civil Supplies & Consumer Affairs/Legal Metrology Department for effective monitoring of rate change and passing of benefit to the customers due to reduced tax rates.

Conduct of Enforcement drive : The Department shall nominate 10 Officers (5 each from Jammu and Kashmir divisions) who shall participate in the drive for enforcement of revised GST rates. Also details of circle officers in the different districts along with their telephone numbers shall be shared with Deputy Commissioners for participating Joint Enforcement Teams in conducting market survey drives.

Sample checking : The department shall test sample invoices to confirm correct tax computation to ensure the benefits of tax slab

reduction is passed on to the customers.

Transition Handling : The department shall sensitize the taxpayer for transition handling of invoices as under:

• For Invoices raised before effective date-old rate applies.

• For invoices raised on / after effective date new rate applies.

• Issue credit/debit notes if goods are returned/cancelled post- change.

Maintain reconciliation records for transition period.

For Complete Show Order : Click here

👉Join JK Updates WhatsApp Channel 👈

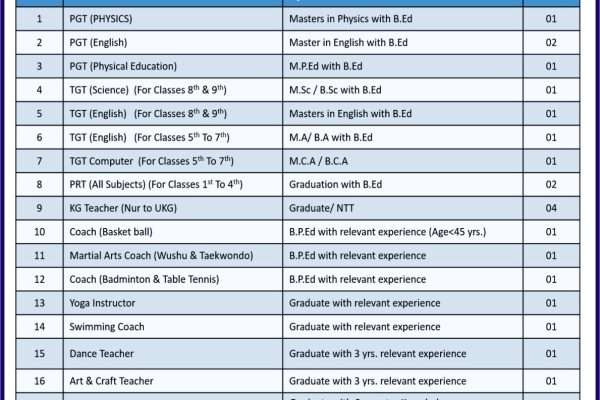

JKPSC Recruitment for 105 Posts

RRB NTPC Graduate Level Online Form 2025, 5800+ Posts

1149 Posts: East Central Railway Recruitment ,Apply Online